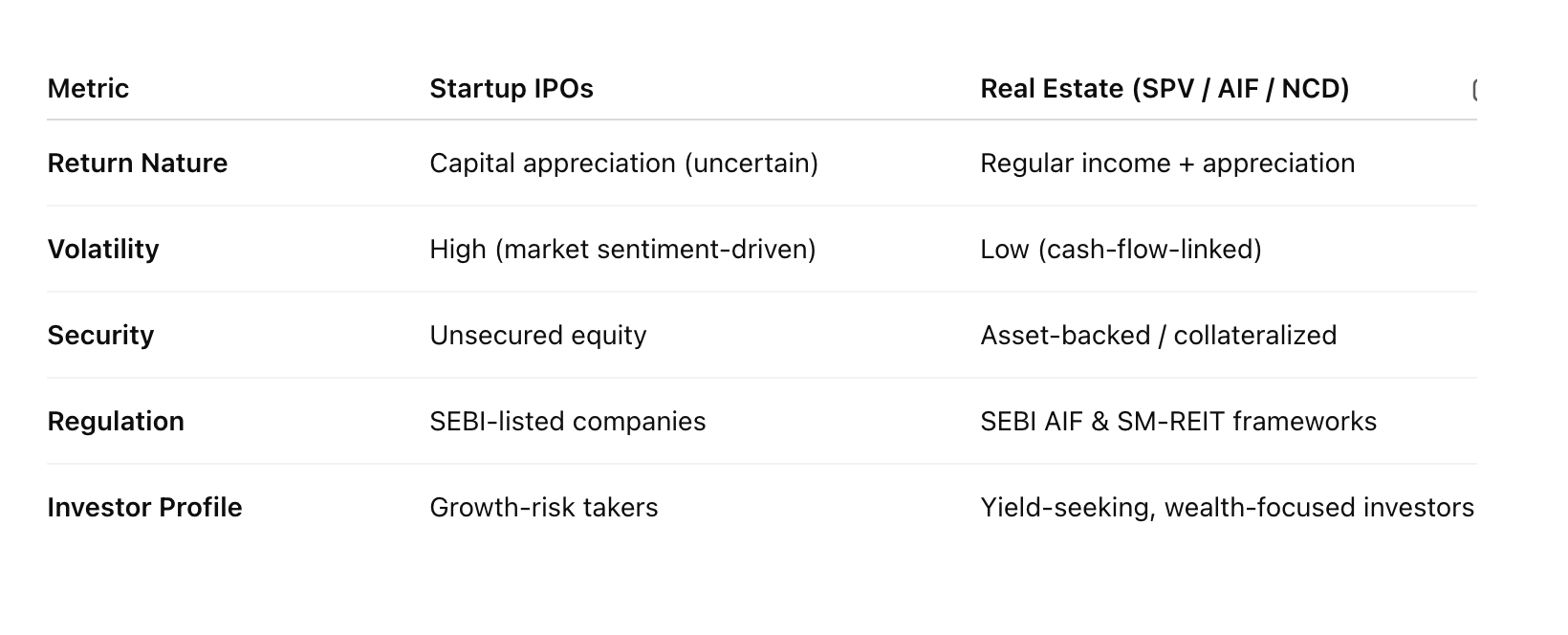

Startup IPOs vs Real Estate: India’s Investment Revolution

In short — startups promise upside; real estate delivers income stability.

Why Smart Money Is Tilting Toward Property Vehicles

- Predictable Yields – Rental or coupon income offers 8–12% steady returns versus volatile IPO gains.

- Institutional Guardrails – SEBI’s SM-REIT regulations ensure standardized valuations, transparency, and governance.

- Professional Underwriting – AIFs managed by HDFC Capital, Kotak Alternatives, ASK, and others bring institutional discipline.

- Diversified Risk – AIF and NCD structures help minimize single-asset exposure and market swings.

- Access & Liquidity – Fractional SPVs reduce entry barriers, while listed NCDs enhance tradability.

Where Each Shines

Startup IPOs – Ideal for investors chasing growth, innovation, and long-term equity plays — with the appetite for volatility.

Real Estate Routes – Best suited for investors seeking stable yields, tangible assets, and predictable income, plus the potential for appreciation.

The Bottom Line

India’s capital markets are maturing fast. While the IPO wave captures headlines, a quieter real estate revolution is driving sustainable wealth creation through AIFs, NCDs, and SPV-based models — blending institutional rigor with asset-backed security.

For investors focused on steady compounding over speculation, real estate’s new-age investment frameworks could be the smarter long game.

Meta Realty’s Take

At Meta Realty, we believe hype creates momentum, but cash flow creates wealth. Our mission is to help investors identify structured, performance-driven real estate opportunities that combine transparency, security, and long-term value.